*Mr. Cuban may receive financial compensation for his support.

Last Updated: April 24, 2024

How to Start an LLC in North Carolina

Did you know North Carolina is an excellent place to start a business? The Tar Heel State ranked at #2 on CNBC’s “Top Places for Business” in 2021. And, if you want your new enterprise to be a limited liability company (LLC) in North Carolina, keep reading.

Many entrepreneurs consider LLCs to be a “best of both worlds” business structure. They can protect the personal assets of the business owners (who are called “members” in an LLC) like a corporation does, but without the double taxation and excessive red tape.

Starting an LLC is a process, and you’ll have to follow the right steps, contend with some paperwork, and follow North Carolina law. Sometimes trying to understand the government processes and regulations can be as confounding as navigating the streets of Charlotte. But don’t worry, we’re here to help. Use our step-by-step guide on how to create an LLC in North Carolina below.

Instead of doing random Google searches for “apply for LLC in NC online,” let this article be a lighthouse to guide your way to starting a North Carolina LLC. We’ll take you through the basic steps. Along the way, we’ll also show you how we can make the process as pleasant as a cool sweet tea (or, if you prefer, a cold bottle of Cheerwine) on a hot day.

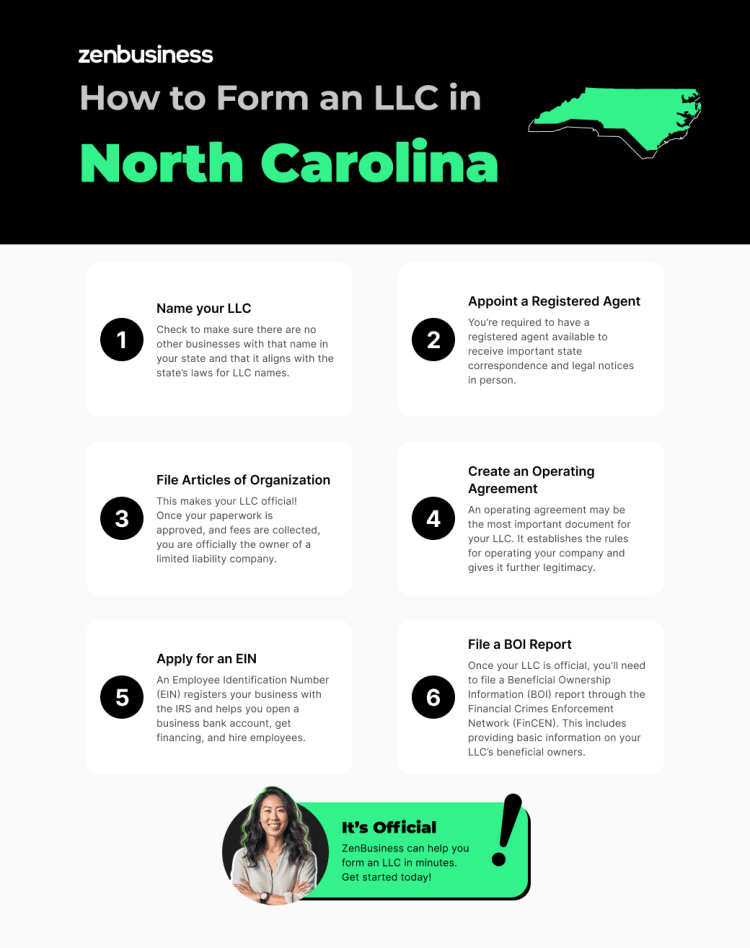

The 6 steps for starting your North Carolina LLC

Below we’ll cover the six basic steps to starting a domestic LLC in North Carolina. This article doesn’t cover how to start a foreign LLC in North Carolina. A foreign LLC is one that originates outside of the state. To do business in another state, you typically need to get a foreign qualification.

- Choose a unique name for your North Carolina limited liability company

- Appoint a registered agent to receive notices for your business

- File your NC LLC Articles of Organization

- Create an operating agreement to establish the rules for your NC LLC

- Obtain your EIN Number with the IRS and review your tax requirements

- File North Carolina BOI report

People in certain licensed professions (such as architects, lawyers, medical doctors, accountants, etc.) who perform a professional service can form a professional LLC, a.k.a. PLLC, in North Carolina. This involves a separate process from what this article covers. We don’t assist with PLLC formations, but you can get more information about them on our North Carolina PLLC page.

1. Name your North Carolina LLC

First, choose a name for your limited liability company. Of course, you can’t just pick any name you want. It has to be unique within the state of North Carolina. It also has to follow the naming guidelines for the state.

It’s important to find an available business name that’s in line with North Carolina law. Otherwise, your paperwork could be rejected, and you’ll have to start the process over. Brainstorm business names until you come up with a short list of favorites so you’ll have options if your first choice isn’t available.

General Requirements for Naming an LLC in NC

There are legal requirements for business names that you must follow in North Carolina. For example, the name can’t contain language that:

- States or implies the business is for any unlawful purpose

- States or implies the business operates in a way not allowed by its formation documents

- Is offensive to accepted standards of decency

Occupational Restrictions

The following words can only be used if you can prove that you’re legally qualified to perform the implied professional services:

- Apothecary

- Architect

- Architectural

- Architecture

- Certified Public Accountant or CPA

- Drug

- Engineer

- Engineering

- Insurance

- Pharmacy

- Prescription

- Prescription Drug

- Realtor

- Rx

- Survey

- Surveying

- Surveyor

- Wholesale

If you intend to operate as a wholesale business, you can use “wholesale” in your LLC’s name. You’ll have to submit a letter with your North Carolina LLC Articles of Organization to explain how you’ll comply with North Carolina wholesale business laws. Depending on the type of wholesale business, you may need to apply for a local or state business license.

“Bank,” “banker,” “banking,” “cooperative,” “co-op,” “mutual,” and “trust” are off-limits, too. State law forbids banking institutions from forming LLCs. If there are prohibited words you would like to use in your name, you can receive permission to do so by applying to the proper legal authority. If the state approves your request, then you can reserve the name to use at a later date.

Required Words for a Limited Liability Company Name

Those words or abbreviations (for example, “Inc.”) you sometimes see after a business name are called “designators.” They indicate what kind of legal business entity a company is. In North Carolina, LLCs are required to have one after their name.

By North Carolina law the name MUST end with one of the following phrases or abbreviations:

- L.L.C.

- Ltd. Liability Co.

- Limited Liability Co.

- Ltd. Liability Company

- Limited Liability Company

Check for NC LLC Name Availability

To find out if the name you want to use is available, consult our North Carolina business name search page. The North Carolina Secretary of State’s office also suggests the following:

- Do an extensive online name search.

- Check the register of deeds office in your county and nearby counties.

- Browse business directories, city directories, and chamber of commerce lists.

- Check with the U.S. Patent and Trademark Office.

- Search the North Carolina Trademark Registration website.

Even if your business name is technically different from another, North Carolina law says it must be “distinguishable.” So, if the only differences are articles, conjunctions, prepositions, punctuation, spaces, and the substitution of an Arabic numeral for a word, that’s not enough to make it distinguishable from another name.

For example, say a successful, well-established Outer Banks seafood business is called “Sal’s Shrimp Shack.” You can’t name your new shop “Sal’s Shrimp Shak” or “Sal’s Shrimp Shack & More.”

You also aren’t allowed to use a different designator to make it distinguishable from a similar name or, worse, slap “Inc.” onto the back of your LLC name to make it appear to be a corporation. No shenanigans, please.

If you’re feeling stuck about finding the right name, we offer some pointers on our “How to Name Your LLC” page.

Reserving a Business Name

Did you find an available name you love, but you’re nervous about someone else nabbing it before you can file your LLC paperwork? North Carolina allows you to reserve a business name for 120 days for a fee.

Filing for an Assumed Name

If you plan to do business under any name other than your LLC’s legal name, you’ll need to file a DBA (“doing business as”) name. This isn’t required if you only plan to use your official name, but sometimes businesses use a DBA if they’re launching a new brand or product line and want to market it under a new name. It’s a lot easier than forming a whole new business.

A DBA name is also known as an assumed business name in North Carolina. All assumed business names are filed at the Register of Deeds offices in counties throughout the state. A statewide online database allows you to do an assumed business name search to see if the name you want to use is available.

File your Assumed Business Name Certificate at the office of your local county Register of Deeds. Even if you do business in multiple counties, you only have to file one application. Just designate which counties you plan to operate within on the form.

There’s a filing fee to pay. You can also amend or withdraw your Assumed Business Name Certificate at any time.

Find a matching domain name

Here in the 21st century, you’ll want your business to have an online presence. Even if you don’t sell things directly online, you want people to be able to find your business on the web.

Is your LLC name available as a web domain?

An important factor when weighing your business name options is whether your desired name is available as a domain name on the web. Getting a business name that’s also available as a URL means you’ll have a website that’s easier to market.

We have a domain name search tool to help you see if the name you want is available. When you find an available domain name you like, it’s wise to secure it before someone else does.

If you want to market on social media, check to see what handles are available on Facebook, Instagram, and similar sites.

If you need help with your LLC’s online presence, we have a domain name service to help you find and purchase a domain name for your company. We can also help you create an affordable business website and provide domain name privacy.

One of the factors in choosing your business name will likely be choosing one that pairs well with an available domain name you can use for your website. If you can’t find any available URLs that are even close to what your desired business name is, you may want to consider another business name.

We have a domain name checker to help you see what names are available on the web.

Consider registering a trademark

It’s wise to check as many sources as possible to ensure your desired business name isn’t trademarked. You may also want to pursue getting a trademark of your own for your business name or logo.

A trademark can be a word, phrase, symbol, design, or any combination of such. It’s used to identify your goods as yours and to distinguish your products from others. A service mark is similar but is used for advertising services instead of goods. It also sets your services apart from competitors.

Trademarks can be both federal and state. A federal trademark requires you to apply through the U.S. Patent and Trademark Office, which can be a long, involved process. State trademarks only apply within the borders of your state, but they’re easier and quicker to get.

The Trademarks Division of the Office of the North Carolina Secretary of State handles in-state registrations. They thoroughly examine marks and apply all applicable state and federal laws and examination procedures. If they find the mark to be eligible, they can guide you through the registration process.

Ready to Start Your North Carolina LLC?

Enter your desired business name to get started

2. Appoint a registered agent in North Carolina

Select a registered agent in North Carolina. By law, limited liability companies must appoint and keep a registered agent. This refers to an individual or business entity that’s responsible for accepting important official notices, such as subpoenas, in person and forwarding them to the business owner.

Under state law, the registered agent must be either a North Carolina resident with a street address in the state or a business entity authorized to do business in North Carolina (N.C.G.S. § 55D-30). The place where the registered agent accepts notices is called the registered office, and it must be a physical address in North Carolina.

You can’t use a P.O. box for the registered office. A process server must be able to deliver notice of a lawsuit in person.

Should you be your own registered agent in North Carolina?

You may think that you want to hold this position yourself, but it can end up being a pain. The registered agent is required to be at the designated office during all normal business hours to receive service of process in person.

In addition, being served with a lawsuit in front of clients can be bad for business.

What if the state can’t find my North Carolina registered agent?

Being your own registered agent or appointing someone you know sounds good until a process server (someone who delivers notification of a lawsuit) can’t find you or your agent when they need to.

This can easily occur if you or your appointee isn’t in the office when the process server comes around. It can also happen if the agent moves or quits and you fail to appoint a new agent or update the Secretary of State office about the new address.

If a process server can’t find the registered agent for your business, a lawsuit against you could go forward without your knowledge, meaning you’ll have no opportunity to defend yourself. That often leads to a default judgment against you.

ZenBusiness can provide your registered agent

When you use our registered agent service, we’ll provide you with an agent who’s available to receive important legal and other notices in person. This gives you the peace of mind of knowing you’re in compliance with the registered agent requirements. And, it helps avoid embarrassing situations where you could be served papers for a lawsuit in front of clients and employees.

As a bonus, our service also keeps you organized. When you get important documents, we will quickly inform you and keep them together in your online digital dashboard so that you can view, download, and/or print them whenever you want. It’s better than rummaging through piles of papers to try to find important legal documents when you need them.

Using a registered agent service can alleviate these problems. If you’re ever served notice of a lawsuit, you’ll know that someone will be available to receive it. That eliminates the worry of being out of compliance. Registered agent services also help ensure that a potentially embarrassing event like that will happen at a registered office away from your main place of business.

3. File North Carolina Articles of Organization

In North Carolina, you file your Articles of Organization, which officially forms your Limited Liability Company (LLC), with the North Carolina Secretary of State. Here’s how to file your Articles of Organization:

Obtain the Form: You can download the Articles of Organization form (Form L-01) from the North Carolina Secretary of State’s website.

Complete the Form: Fill out the form completely and accurately. You will typically need to provide the following information:

- LLC name: Make sure the chosen name is unique and complies with North Carolina naming requirements.

- Registered agent information: Include the name and address of your registered agent, who will receive legal documents on behalf of the LLC.

- Principal office address: Provide the address where the LLC’s main business activities will take place.

- Organizer information: List the names and addresses of the LLC’s organizers, who are responsible for filing.

Filing Fee: For the Articles of Organization in North Carolina is typically $128. However, fees can change, so check the current fee schedule on the North Carolina Secretary of State’s website.

Submit the Form:

- You can file the Articles of Organization online through the North Carolina Secretary of State’s website using the eCorp system, which is the recommended and quickest method.

- Alternatively, you can mail the completed form along with the filing fee to the following address:

North Carolina Department of the Secretary of State P.O. Box 29622 Raleigh, NC 27626-0622

Cover Letter

It’s recommended that you include a cover letter with your documents. You can download a form for the cover letter on the forms section of the North Carolina Secretary of State website. It’s a simple step that helps the filing process go much smoother.

The cover letter includes your contact information and your preferred processing method: regular, same-day, or 24-hour. You’ll note which return method you prefer, either via mail, email, or in person.

Processing Time

Processing times vary, but most filings submitted online take 7 to 10 business days at this time. Filings submitted by postal mail will take substantially longer, approximately 10 to 15 business days. The Secretary of State office calculates processing time based on when they receive a document to when they return it to the filer.

If you want faster processing, you have a couple of options. The Secretary of State offers 24-hour processing for an additional fee and same-day processing for a higher fee. For the same-day processing, they must receive your paperwork by noon.

Why would I delay my LLC’s filing date?

Some new business owners, especially if it’s near the end of the calendar year, will delay their LLC filing date to January 1 of the coming year. This way they can avoid the hassle and cost of having to pay taxes on their LLC in the current year. This is especially true if the future LLC owners don’t need to establish the company right away.

Delayed filing is something else we can help you with. When you form your LLC in North Carolina with us, we give you the option of paying an extra fee to have your LLC’s effective date delayed. (This service is only offered from October to January.)

Amend Your Articles of Organization With the Secretary of State

You only need to file your Articles of Organization once. But if any of the original information needs to be updated, altered, or expanded, your business is required to inform the state about the changes.

You would record these changes by filing North Carolina Articles of Amendment and paying a filing fee. If your Articles of Organization isn’t current, it could impact your ability to get a North Carolina Certificate of Existence (also called a “Certificate of Good Standing”). This document isn’t required to conduct business, but it’s important for business accounts, members, and potential investors. Basically, failing to keep your business up to date with state requirements can limit your LLC’s potential future growth.

Need help amending your Articles of Organization? We have an amendment filing service that can handle it for you, as well as our Worry-Free Compliance service, which includes two amendment filings every year.

Keep your paperwork digitally organized

If you have us handle filing for you, once the state approves your LLC, your paperwork will be available from your ZenBusiness dashboard, where you can keep it and other important paperwork digitally organized.

Once you get your physical paperwork back from the Secretary of State approving your new LLC, you’ll want to keep it in a safe location along with your other important paperwork, such as legal documents, your LLC operating agreement, member certificates, contracts, compliance checklists, transfer ledger, etc. We offer a customized business kit to keep these important documents professionally organized.

4. Create an operating agreement

Make an operating agreement for your North Carolina LLC. While not required by state law, creating an LLC operating agreement is one of the most important things you’ll do when forming your LLC. This document sets the rules for how your company is going to operate so that everyone involved knows what to expect and how things will work.

What information should be included?

Good operating agreements address the following questions and more:

- Who are the LLC owners?

- How much of the LLC does each own?

- Who manages the LLC?

- Who gets to vote on important decisions?

- How are the profits divided?

- What are the LLC’s terms and conditions?

- What happens when an LLC member leaves?

- Can additional members be admitted?

- What circumstances could lead to the LLC’s dissolution?

- What happens when the LLC is dissolved?

Benefits of Creating an Operating Agreement

There are many benefits to creating an operating agreement. For example:

- More protection: The formality of an operating agreement further legitimizes your LLC, especially in the eyes of the court. It helps others to see your LLC as a real business that is entirely separate from your personal affairs. This separation adds another layer of legal protection between your business and personal assets.

- Less fighting: Friends and family members often go into business together when forming an LLC. Operating agreements keep everyone on the same page and can stop fights before they begin since everyone agreed to the rules beforehand.

- All your way: If you don’t have an operating agreement and a problem comes up, you’ll have to abide by North Carolina state rules for LLCs. Address issues and how to best deal with them in your agreement. This way, problems can be resolved your way and not the state’s.

- Ownership details: The agreement can define what percentage each member of the company owns and how much they contributed in capital. It can also include how expenses and profits should be shared.

- Clear dissolution rules: Include specific details about what events could lead to the dissolution of your LLC. Lay out the terms of the dissolution and any further information about succession, too.

- Funding: Having an operating agreement can help you secure lines of credit or business loans from a bank.

When does an operating agreement become a must-have?

Your operating agreement helps your business in many ways. Even though the North Carolina government doesn’t require the agreement, others may request to see it. You may need to show it to:

- Potential investors or business partners

- Financial and legal professionals

- Title companies when purchasing real estate

If you’re unsure as to how to start creating an operating agreement for your LLC in North Carolina, then check out this guide. Make note that, if you decide to form your LLC with ZenBusiness, all our plans include a customizable operating agreement template to save you time researching and crafting the agreement yourself.

Do I need an operating agreement if I’m the only owner?

It’s a good idea. Many things in operating agreements are intended to avoid disputes among the LLC members, so you may think you don’t need one for a single-member LLC. But an operating agreement can benefit you even if you’re the sole owner.

Potential lenders and investors, future business partners, and others may want to see your operating agreement. Some banks won’t let you open a business bank account for your LLC without one. Your operating agreement can also spell out what you want to happen to the business if you die or become incapacitated.

Further, if you end up in court, having an operating agreement will help further demonstrate that you and the business really are separate entities, thus giving you better personal asset protection. Personal and business assets are kept farther apart.

5. Apply for an EIN

Get an Employer Identification Number (EIN) for your LLC. To identify a business, the federal government uses an EIN. Each business has a unique EIN assigned to it. It’s also known as a Federal Employer Identification Number (FEIN) or federal tax identification number. The Internal Revenue Service (IRS) uses your EIN for tax purposes.

You’ll use your EIN to open a business bank account, set up retirement plans, apply for financing, file taxes, and stay in good standing overall. You’re also required by law to have one if your LLC has more than one member or has employees.

How to Apply for an EIN

You get your EIN from the IRS by going to their website and filling out an application. You can also do it by postal mail by completing a form and sending it to the Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999. It will likely take four weeks, whereas the online version is immediate.

If you’d rather fill out as few IRS forms as possible, we can get your Employer Identification Number for you. Our EIN service is quick and easy to use.

6: File a beneficial ownership information report

At the beginning of 2024, the terms of the Corporate Transparency Act took effect, requiring LLCs (and many other small businesses) to file a beneficial ownership information report, or BOI report. The Act requires this report with the goal of promoting financial transparency; by requiring businesses to disclose information about their beneficial owners, the Act hopes to prevent businesses from using shell companies to hide illegal financial activities.

Beneficial owners are anyone who holds 25% or more of the company’s ownership interest, receives substantial economic benefits from the business assets, or exerts substantial control over the company. When you file a BOI report with the Financial Crimes Enforcement Network (FinCEN), you will list information for each beneficial owner: their full name, address, and their identifying documents.

North Carolina doesn’t have a separate version of this form, so you’ll only need to file with FinCEN. You can file online or by uploading a PDF of the form; there’s no filing fee.

For LLCs that organize in 2024, the BOI is due within 90 days of North Carolina approving your Articles of Organization. LLCs formed before January 1, 2024, have to file by January 1, 2025. All LLCs created in 2025 or later will have just 30 days after approval to file their BOI report. For more info, please see FinCEN’s website.

Our BOI filing report service can help file this form for you.

Register with the Department of Revenue

Speaking of taxation, don’t forget about state taxes. To pay state taxes for your business, you must register with the North Carolina Department of Revenue and receive a tax account ID number. You’ll need this number for income tax withholding, sales and use tax, and other taxes.

There’s no fee to submit your business registration application online. You can also file Form NC-BR for free in person or by mail.

The Department of Revenue’s business registration checklist can help you prepare to file for a tax account ID number. You’ll need to gather information such as:

- Your federal EIN

- Your business name, address, and phone number

- Name, title, address, and Social Security number of the responsible person

- Details about your business

After you submit your online application, you’ll receive a confirmation page. A notice with your official tax account ID number will be mailed to you within five to 10 business days, depending on system processing times. You can file and pay taxes with the Department of Revenue once your ID number has been issued.

If you plan to hire employees in North Carolina, you’ll be subject to unemployment insurance tax. You’ll need to create an unemployment insurance tax account with the North Carolina Division of Employment Security.

Can filing as an S corp lower my taxes?

The LLC business structure was created to be flexible, and one of those flexibilities comes in how you can choose to have your LLC taxed. One method of taxation could save you a substantial amount over another method, so you’ll want to consider this carefully before you start an LLC.

By default, you’re taxed as a sole proprietor if your LLC has only one member or a partnership if it has multiple members. This appeals to most owners of LLCs because it avoids “double taxation” of C corporations (the default form of corporation), in which a business pays taxes at both the business level and again when the income is paid to the individual owners. But some LLCs opt to be taxed as a C corporation or an S corporation because, in their particular case, it works to their advantage.

Being taxed as a C corporation does mean facing double taxation, but, for certain LLCs, the pros can sometimes outweigh the cons. C corporations have the widest range of tax deductions, which could be an advantage in some scenarios. For example, the cost of certain benefits can be written off as a business expense.

S corp is short for “Subchapter S Corporation.” It’s a tax filing status geared toward small businesses. Having your LLC taxed as an S corp gives it pass-through taxation like a standard LLC, but there’s another potential advantage: It could save you money on self-employment taxes.

In a standard LLC, you would pay self-employment taxes (Social Security and Medicare) on all of the profits you receive from the company. But an LLC with S corp status allows you to be both an owner and an employee of your LLC and split your income into your salary and your share of the company’s profits.

In this way, you pay the standard employment taxes on your salary, but you pay no self-employment taxes on the rest of your profits. (You still pay the other forms of income tax, of course.)

The drawback is that the Internal Revenue Service scrutinizes S corps more closely, meaning you’re more likely to get audited. S corps are also harder to qualify for.

While it’s possible that one of the above options could work better for your LLC, we don’t need to tell you that taxes are very complicated. They’re also very specific to your situation. That’s why you really need to consult a tax professional to see which taxing method works best for your LLC.

If you do decide that filing as an S corp is right for your North Carolina LLC, we have an S corp service that can help you do that at the time of your LLC’s formation.

Next Steps after Forming Your LLC

After successfully forming your North Carolina LLC, there are critical steps to ensure your business operates smoothly and remains in compliance with state regulations. Here’s a guide to the essential tasks that should follow your LLC’s formation:

Open a business bank account: Separating your LLC’s finances from your personal accounts is crucial for maintaining financial clarity and legal protection. Open a dedicated business bank account to manage income, expenses, and transactions related to your LLC.

File annual reports: In North Carolina, LLCs are required to file an annual report with the Secretary of State. This report confirms your LLC’s current information, including the registered agent and office address. The deadline for filing is on or before April 15th each year, starting from the year following your LLC’s formation.

Obtain necessary licenses and permits: Depending on your industry and location, your North Carolina LLC may require various licenses and permits to operate legally. Research and obtain the required licenses, such as local business licenses or industry-specific permits.

Secure business insurance: Protect your LLC and its assets by obtaining the necessary business insurance coverage. Common types include general liability insurance, professional liability insurance, workers’ compensation insurance, and property insurance, among others. The specific insurance needs can vary based on your business activities and industry.

Stay informed about regulations: Keep up to date with state and local regulations, especially those relevant to your industry. Being aware of changing laws and compliance requirements helps ensure that your LLC operates within the legal framework.

Maintain records: Keep accurate records of your LLC’s financial transactions, contracts, and important documents. Organized record-keeping simplifies tax reporting, financial analysis, and regulatory compliance.

Pay state taxes: Fulfill your North Carolina state tax obligations, including income tax, sales tax (if applicable), and any other relevant taxes. Register for tax accounts as needed and file returns on time.

Comply with employment laws: If your LLC has employees, adhere to federal and state employment laws, including wage and hour regulations, employee benefits, and workplace safety standards.

By diligently following these post-formation steps, you can set a strong foundation for your North Carolina LLC’s success. Staying compliant, organized, and informed will help your business thrive and navigate the ever-evolving landscape of state and local regulations. If you have questions or need assistance with any of these tasks, consider consulting legal and financial professionals or business advisors for guidance tailored to your specific needs.

What are the benefits of an LLC in North Carolina?

The benefits of forming an LLC include:

- Flexible ownership and management structures

- Personal asset protection from the business’s debts and lawsuits

- Exemption from double taxation

- Less regulation and more flexibility than corporations

Doing business in North Carolina comes with its own set of benefits. For example:

- Educated workforce: With over 50 colleges and universities and almost 60 community colleges, North Carolina workers are well-educated, skilled, and ready to work.

- Pro-business climate: North Carolina has consistently been recognized for its pro-business environment in recent years. Low taxes, low business costs, and a favorable legal and regulatory environment all play a part.

- Prime location and infrastructure: North Carolina enjoys an excellent location on the East Coast of the U.S. Almost half of the country’s population is within a day’s drive of the Tar Heel State. The state’s supply chain is enhanced by four international airports, two deep-water seaports, and a reliable railroad system.

- High quality of life: North Carolina has consistently ranked low in the cost of living and high in residents’ personal satisfaction.

- Business incentives: North Carolina operates targeted, performance-based incentive programs for those doing business in the state.

Learn more about the many benefits of the LLC business structure to see if it’s the best option for your business.

Different LLC Types in NC

In North Carolina, LLCs can take on different forms to suit the needs of various businesses. Here’s a brief description of each type of LLC:

Single-Member LLC (SMLLC): A single-member LLC is an LLC owned by a single individual or entity. It offers liability protection for the owner’s personal assets while simplifying management, as there’s only one member. Income and losses are typically reported on the owner’s personal tax return.

Multi-Member LLC: Multi-member LLCs have two or more owners, known as members. Each member’s investment, share of profits, and management responsibilities are defined in the LLC’s operating agreement. Like SMLLCs, multi-member LLCs provide personal liability protection for members.

Manager-Managed LLC: In a manager-managed LLC, members designate one or more managers to handle the day-to-day operations and decision-making of the LLC. This structure is suitable when members prefer a hands-off approach to management.

Member-Managed LLC: In contrast, a member-managed LLC allows all members to actively participate in the management and decision-making of the business. This structure is common in small, closely-held LLCs where all members want a say in operations.

Professional LLC (PLLC): A professional LLC is reserved for licensed professionals, such as doctors, lawyers, architects, and accountants. It allows professionals to form an LLC. Members must hold the appropriate professional licenses.

Foreign LLC: A foreign LLC is an LLC originally formed in another state but registered to do business in North Carolina. Foreign LLCs must comply with state regulations to operate legally within North Carolina.

Domestic LLC: A domestic LLC is one formed in North Carolina to conduct business within the state. It’s the most common type of LLC for businesses established in North Carolina.

Choosing the right type of LLC depends on factors such as ownership structure, management preferences, and the nature of the business. Each type offers specific advantages and considerations, so it’s essential to carefully assess your business needs and consult with legal and financial professionals to make an informed decision when forming your North Carolina LLC.

Alternative Business Structures in North Carolina

In addition to LLCs, North Carolina entrepreneurs have several options when it comes to selecting a business entity to operate their ventures. Here are some of the most common types of business entities available in the state:

Sole Proprietorship: A sole proprietorship is the simplest form of business, where an individual operates and owns the business personally. The owner is personally liable for business debts and obligations.

General Partnership: In a general partnership, two or more individuals or entities manage and own the business together. Partners share profits, losses, and management responsibilities. Partners in a general partnership have personal liability for business debts.

Limited Partnership (LP): A limited partnership consists of both general partners (with management responsibilities and personal liability) and limited partners (who invest capital but have limited liability). Limited partners are not involved in day-to-day operations.

Corporation: A corporation is a separate legal entity from its owners (shareholders). It offers limited liability protection to shareholders, meaning their personal assets are generally shielded from business liabilities. Corporations can be C corporations (subject to double taxation) or S corporations (pass-through taxation).

Limited Liability Partnership (LLP): An LLP is typically formed by licensed professionals, such as lawyers or accountants, who want to work together but maintain personal liability protection. Each partner is not personally liable for the negligence or misconduct of other partners.

Professional Corporation (PC): Similar to a regular corporation, a professional corporation is formed by licensed professionals, such as doctors, dentists, or engineers.

Nonprofit Corporation: Nonprofit corporations are organized for charitable, educational, religious, or other nonprofit purposes. They are exempt from certain taxes and often seek donations and grants to support their missions.

Benefit Corporation: Benefit corporations are a relatively new business entity that incorporates social and environmental goals into their mission. They are required to consider the impact of their decisions on society and the environment, not just shareholder profit.

Choosing the right business entity in North Carolina depends on factors like liability protection, tax implications, management structure, and the nature of the business. It’s advisable to consult with legal and financial professionals to determine the most suitable entity for your specific business goals and needs.

How do I dissolve my LLC in North Carolina?

To dissolve your LLC in North Carolina, you’ll need to fill out an Articles of Dissolution form and submit it to the North Carolina Secretary of State’s office. There is a filing fee for dissolution.

- Complete the form, providing the following information:

- LLC name

- Date of dissolution

- Reason for dissolution (e.g., unanimous member consent)

- Signatures of all members or an authorized person

- Include the filing fee, which is typically around $30. Check the latest fee schedule on the Secretary of State’s website.

- Mail the completed form and payment to the following address:

North Carolina Department of the Secretary of State P.O. Box 29622 Raleigh, NC 27626-0622

For more information, visit our North Carolina business dissolution guide.

We can help

Once you’ve finished the steps above, you’re the new owner of a limited liability company! You’ve taken the first steps to becoming the entrepreneur you’ve been wanting to be. But there’s a lot more to know than just how to start an LLC in NC. You need to know about things like hiring employees, getting business licenses and permits, getting additional financing if you need it, how to make changes in your business, and how to stay in compliance with the government.

Our many services can do more than just help you form your LLC. Our business experts can also give you long-term business support to help start, run, and grow your company.

So, if the paperwork of starting a business feels overwhelming, we can help. Let us take care of LLC formation, compliance, and more. That way, you can get back to running your dream business, whether it’s a recruiting agency in Raleigh or a moving company in Asheville.

NC LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Related Topics

North Carolina LLC FAQs

-

Unlike some states, North Carolina doesn’t require a statewide general business license to do business in the state. Still, you’ll need to make sure your LLC has all the licenses and permits it’s required to have by law.

Licensing varies by industry and location and can occur on the federal, state, and local levels. The possible licenses required for your LLC could range from building permits to occupational licenses to zoning permits.

Because of this, there’s no central place to check to see if you have all the licenses and permits you need. You’ll have to do some research.

If you don’t have the time or inclination to do all this research, or if you just want the peace of mind to know that your business has all the licenses and permits it’s legally required to have, our business license report service can do the work for you. -

In North Carolina, the state fees for forming an LLC range from $125 to $230, depending on factors such as whether you choose to reserve your business name or want expedited filing.

All checks must be payable to the North Carolina Secretary of State. Note that fees change over time, so you should check the state website for the most recent fee schedule.

-

When it comes to small business taxes in North Carolina, you have a lot of angles to consider. As an LLC owner, the profits you make will usually be taxed on your personal income tax return, but let’s go into a little more detail.

Federal Taxes

By default, an LLC with only one member is taxed as a “Disregarded Entity” at the federal level, which is the same as being taxed as a sole proprietorship. This means that profits aren’t taxed at the business level, but only when they become the member’s income.

LLCs with multiple members are taxed as a partnership by default. As with a single-member LLC, the income is taxed at the individuals’ level and not the business’s. This avoids the “double taxation” that corporations pay, in which profits are taxed at the corporate level and again when they’re paid out to the owners (“shareholders”).

Single-member LLCs don’t have to file a separate federal return for their LLC. They report the LLC income on their personal income tax return (Form 1040). But LLCs with multiple members must file a separate information federal return for the LLC, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

LLCs also have the option to be taxed as corporations. Some LLC members choose to classify their businesses as an S corporation or a C corporation, which can be advantageous in some cases. In particular, many LLCs elect to be taxed as S corporations because it can save the members money on self-employment taxes. You can learn more on our What Is an S Corp? page.

There are also a few other forms of federal taxation to keep in mind. For example, you will likely need to pay certain kinds of self-employment and/or employment taxes, such as Social Security, Medicare, and unemployment.

Even for business entities like LLCs, taxes can get very complicated. Don’t hesitate to consult a tax professional. They could potentially find tax savings you weren’t aware of as well as keeping you out of trouble with the IRS.

State Income Taxes

When it comes to state income tax and your LLC, North Carolina treats LLCs the same way as the federal government. The LLC itself doesn’t pay state income taxes on its profits, just the individual members.

Sales and Use Tax

North Carolina imposes sales and use tax on goods sold within the state. Many local governments also impose a sales tax for items sold within their jurisdiction. Companies collect state and local sales tax to remit to the taxing authority.

The state sales tax rate as of 2023 is 4.75%. Counties add their tax rate to the state tax rate to calculate the total tax rate. Some items sold in North Carolina are subject only to state sales tax. Other items may be subject to a combined general tax rate or a miscellaneous rate.

Small business owners are responsible for verifying the correct tax rate for goods sold and collecting that tax rate from consumers. A list of who should register for sales and use tax is on the North Carolina Department of Revenue’s website.

Unemployment Tax

A small business in North Carolina must pay unemployment insurance tax if its gross payroll is at least $1,500 in a calendar quarter or if it employs at least one person during 20 different weeks in a calendar year. In addition, other companies may be subject to unemployment tax. A complete list is available online at the North Carolina Department of Commerce website.

Companies register with the Division of Employment Security of the North Carolina Department of Commerce to file and pay unemployment taxes. Companies create an online account to manage their unemployment taxes.

Franchise Tax

North Carolina imposes an annual franchise tax on corporations authorized to do business in the state unless the company is specifically exempted under state law. Your LLC only has to worry about this tax if it’s elected to be taxed as a corporation, though.

Excise Tax

Excise taxes are charged on specific items sold within North Carolina. The tax is in addition to sales and use tax. Not all items are subject to an excise tax. Items subject to excise tax include, but are not limited to, cigarettes, cell phone plans, alcohol, real estate, and gasoline.

Local Taxes

In addition to federal and state taxes, you may be responsible for local taxes, which could include taxes levied by your county, city, school district, etc. You’ll need to check with all your local taxing authorities to determine what you’re responsible for.

-

This will vary by factors such as the time of year and how busy the office is, but the processing time for your Articles of Organization is approximately 7 to 10 business days when you file online, starting from when the document is received.

Filings submitted by postal mail will take substantially longer, approximately 10 to 15 business days. The Secretary of State Business Registration Division also offers 24-hour and same-day processing for a fee.

-

No. North Carolina doesn’t require you to file your operating agreement with the state. However, it highly advises you to create one, as it has many benefits for your LLC.

-

Most LLC members have their business taxed the default way, which is as a sole proprietorship (for single-member LLCs) or a partnership (for multi-member LLCs). This method only requires partners to pay taxes on their percentage of the profits on their personal tax returns. The LLC itself is not taxed.

Other options include being taxed as a C or S Corporation. Each tax structure has its advantages and disadvantages.

The right tax structure for your LLC depends on many factors, such as profits and the number of members. It’s best to talk to a qualified accounting professional to understand all your options and choose the right tax structure for your LLC.

-

No, North Carolina doesn’t allow Series LLCs. This business structure has an “umbrella” LLC under which one or more LLCs are organized. It’s a relatively new way to structure an LLC, and not all states allow them at this time.

-

To reinstate a North Carolina LLC after dissolution, fill out an Application for Reinstatement form and submit it to the Secretary of State’s office with the required filing fee.

-

Yes. The annual fee is part of the annual report requirement that is mandatory for all LLCs in North Carolina. The annual report is due by April 15th of each year and must be accompanied by a filing fee. If you need help filing your LLC’s annual report, see our North Carolina annual report page.

-

The North Carolina PLLC (professional limited liability company) formation process is not much different from that of an LLC. However, there are some additional regulations that apply to this type of business entity. For example, the owner of the PLLC must be certified as a licensed professional by the applicable licensing board. You’ll also complete a different form for the Articles of Organization.

-

Yes, a foreign LLC can conduct business in North Carolina. However, the state law requires that it obtains a Certificate of Authority, specific to its entity type, from the NC Department of the Secretary of State Business Registration Division. See the Foreign Business section of the North Carolina Secretary of State page for more information.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

Written by Team ZenBusiness

North Carolina Business Resources

LLC Formation Near North Carolina

Ready to Start Your LLC?