*Mr. Cuban may receive financial compensation for his support.

Updated:April 24, 2024

Business-savvy Hoosiers know that Indiana isn’t just college basketball and cornfields. It’s also a business-friendly state, just as an LLC is a business-friendly concept. If you’re thinking of starting an LLC, Indiana may be a good place to do it.

A limited liability company (LLC) is a business entity type that allows its owners (called “members” in an LLC) to have the personal limited liability protection of a corporation with the tax benefits and flexibility of a partnership or sole proprietorship.

LLCs avoid the “double taxation” of a typical corporation, in which profits are taxed both at the business level and again on the personal level. LLCs also bypass many of the structural and reporting requirements of a corporation while protecting the personal assets of the owners in the event the business is sued or goes into debt.

But even though setting up an LLC in Indiana has fewer administrative hoops to jump through than a corporation, they’re still not as fun as shooting basketball hoops. If you’ve never started a business before, the process can seem as mysterious as the origins of the word “Hoosier.”

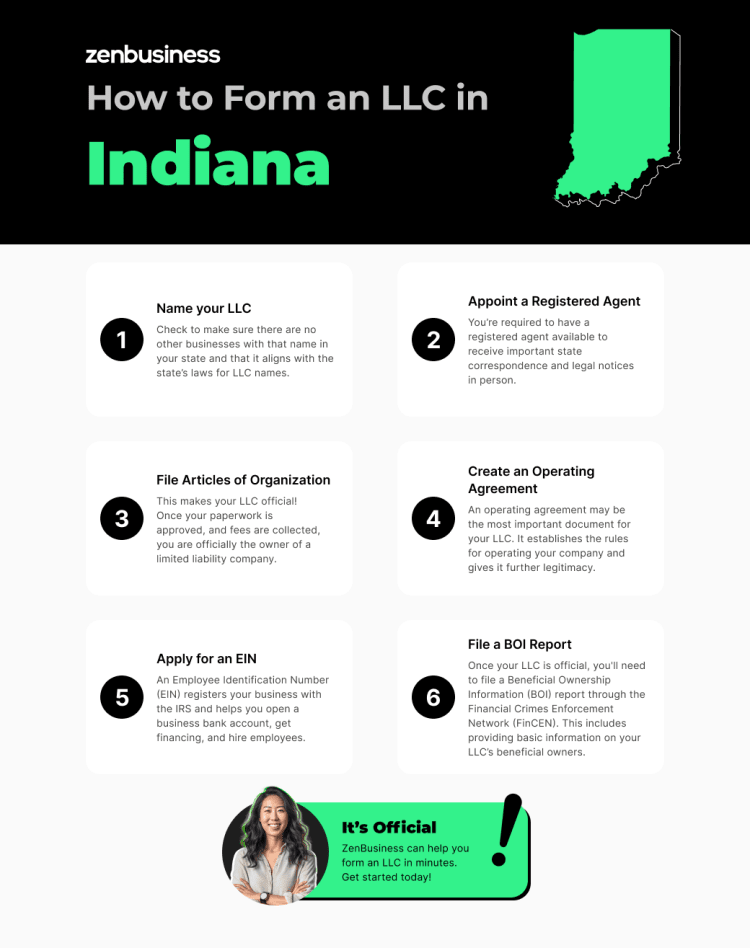

How to Start an LLC in Indiana

Don’t worry. This article will take you through the steps to create an LLC in Indiana. Along the way, we’ll show you how our many business services can make the process easier still.

First, you’ll need to find an acceptable name for your LLC and secure a registered agent. From there, you’ll be able to file Articles of Organization with the Indiana Secretary of State. Next, you’ll likely want to create an operating agreement and get a federal tax identification number.

Note: These are the steps for creating a domestic LLC in Indiana, meaning one that originates within the state. To create a foreign LLC — one that originated in another state but wants to do business in Indiana — you would need to complete a Foreign Registration Statement, pay a fee, and follow a different process.

Okay, off to the races: Let’s show you how to start an LLC in Indiana.

- Name your Indiana LLC

- Appoint a registered agent in Indiana

- File Indiana LLC Articles of Organization

- Create an operating agreement

- Apply for an EIN

- File your LLC’s BOI Report

Step 1: Name your Indiana LLC

Choose a name for your Indiana LLC. Brainstorming a name for your new business can be fun, but just remember you have to conform to Indiana naming requirements. If the Indiana Secretary of State rejects your business name, your whole filing will be rejected. You’ll have to start the whole process over, which is both a pain and a delay.

Indiana LLC Naming Guidelines

Whatever name you choose will need to comply with Indiana’s statutes for naming businesses (IC 23-0.5-3). Among them are:

- The name of your Indiana limited liability company must contain a “designator,” which is a word or phrase indicating what kind of business entity it is. An Indiana LLC must have the designator “limited liability company” or the abbreviation “L.L.C.” or “LLC” in its name.

- Your business name must be unique within the state. It must be distinguishable from all other businesses in Indiana, so very minor alterations aren’t enough. For example, changing the designator isn’t a significant change. (And don’t try to deceive the public by using a designator that doesn’t reflect your entity type, such as adding “Inc.” to your LLC name.)

- You can’t use the word “bank” or any derivative of it unless you get approval from the Department of Financial Institutions.

Finding a Unique Name

When choosing a name for your limited liability company, you need to ensure that it is unique from any other business in the state of Indiana. You can do a quick business search by following the instructions on our Business Entity Search for Indiana page. There, you can verify that the name you want is available.

When using the name availability search, the Indiana Secretary of State website cautions, “It is only a preliminary search, meaning the name cannot be guaranteed as available until the final processing is completed at the time of filing. You should not rely, in any way, upon this preliminary information.”

If you’re having trouble thinking of a unique and effective name, check out our “How to Name Your LLC” page for inspiration.

Reserving a Business Name for Your Indiana LLC

When you do find an available name, the state gives you the option to reserve it for 120 days. To do so, you’ll need to submit the Reservation of Business Name form online and pay a $10 fee. You may want to do this if you’ve found the perfect name but aren’t quite ready to file your Articles of Organization yet.

Before committing to a name, though, there are still a couple of other considerations.

Check for a matching domain name

After looking up names on the Secretary of State’s website, you can check whether your desired domain name is available. While many top-level domains exist — “.co,” “.net,” etc. — there’s nothing like getting the “.com” stamp of legitimacy to give some credibility to your business.

We have a tool to help you do a preliminary domain name search, and our domain name registration service can help you secure the online name that will best serve your business.

Is your Indiana LLC name available as a web domain?

Even if you don’t sell your products or services directly online, you’re going to want a presence on the web. At the very least, you want your company’s name, address, and contact info to pop up when potential clients search for it.

That’s why getting a good domain name that pairs well with your business name is so important. You’re likely going to be putting that URL on your business cards and other marketing materials, and you want people to be able to remember it and associate it with your business.

The ideal domain name for your company may already be taken, but you can still find others. In fact, if you find a truly great available domain name, it might be worth naming your business after that URL rather than the other way around.

You can use our domain name search tool to see if your desired business name or something else that’s suitable is available as a URL. If you find such a domain name, you might want to lock it down before someone else does.

You can also check to see what social media handles are available. Many businesses market on platforms like Instagram, Facebook, and Pinterest, so getting the appropriate social media names can be important for effective online marketing.

We have a domain name service to help you find and purchase a domain name for your business. We can also help you create a business website and provide domain name privacy.

Federal and State Trademarks

Even if the Secretary of State approves your limited liability company name, that’s no guarantee that someone else hasn’t already claimed it with a federal or state trademark. To truly check to see if your business name isn’t trademarked isn’t easy because there’s not one single place to check. Some businesses even employ an attorney specializing in trademarks to see if they’re in the clear.

You can take some measures yourself, like searching the trademark database on the United States Patent and Trademark Office website. This can help you determine if someone’s already claimed a federal trademark on the name you want.

State trademarks are applicable within the borders of a state. The Indiana Secretary of State has a trademark search engine where you can see if anyone has a state trademark on your desired LLC name. If you want, you can also apply for your own state trademark on the site.

In addition to checking these databases, it’s wise to do an internet search for your business name, including checking domain names, social media sites, and even phone directories.

Assumed Business Names in Indiana

Sometimes an LLC will want to do business under a name other than its legal name. If “Hank’s Hoosier Bakery, LLC” wants to start offering catering services under the name “Hank’s Hoosier Catering,” Hank would need to get a DBA or “Doing Business As” name in Indiana to legally operate with that name.

The term for a DBA in Indiana is “assumed business name.” An LLC wanting to do business under an assumed name will need to complete and file a Certificate of Assumed Business Name with the Secretary of State. We can help you with this through our DBA service.

Ready to Start Your Indiana LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Indiana

Appoint a registered agent for your LLC. The state and anyone who needs to contact you for legal reasons, such as notification of a lawsuit, need to be able to contact your business. That individual or business entity is called a registered agent in Indiana, and you’re required by law to have one.

Requirements for Indiana Registered Agents

According to Indiana Code Section 23-0.5-4-3, a registered agent in Indiana must be an individual, a general partnership, a domestic filing entity, or a registered foreign entity with a physical street address in the state. Note that the LLC entity itself can’t serve as its own registered agent in Indiana.

The address where the registered agent is located is called the registered office. It can’t be a P.O. box because some legal notices must be delivered in person. Your registered agent also needs to be available at the registered office during normal business hours to receive service of process in person.

Whomever you choose to be your registered agent, you’ll need to get their consent to serve as your agent. You’ll be asked to confirm this when you complete your Articles of Organization later.

What if the state can’t find my Indiana registered agent?

Serving as your own registered agent or appointing a friend or family member to be your agent might seem the simplest way to meet Indiana’s registered agent requirement. But consider what could happen if a process server is unable to find you or your appointed agent.

This can occur if you or your appointee isn’t in the office (for example, they’re out of town, on vacation, sick, etc.) when someone needs to reach the agent. It can also happen if the agent moves or quits and you forget to update your paperwork with the state.

In addition to legal penalties for being out of compliance, failing to maintain a registered agent could mean that a process server can’t find you to notify you of a lawsuit. In that scenario, a court case against you could actually go forward without your knowledge, meaning you wouldn’t even have a chance to defend yourself.

Registered Agent Services

Some new business owners assume they should appoint themselves as their company’s registered agent. However, this approach may have hidden dangers. For example, you could be in the middle of a meeting or client presentation when a process server walks in to deliver a notification that you’re being sued, embarrassing you and derailing the meeting.

Working with an outside registered agent service can help you focus on your business with reduced stress. Additional benefits of hiring an outside registered agent service like ours include:

- Working when it’s convenient for you (your Indiana registered agent must be available during regular business hours)

- Not having to change your registered office address with the state if your business moves

- Ensuring you stay compliant with the legal requirements for having an Indiana registered agent

When you sign up for our registered agent service, we’ll provide you with a registered agent in Indiana, meaning there will always be someone available to receive important legal and other notices from the state.

Step 3: File Indiana LLC Articles of Organization

File your Articles of Organization with the Indiana Secretary of State. Once approved, this step makes your Indiana LLC official. You’ll also need to pay a $97 filing fee at the time you submit the Articles.

When forming an LLC in Indiana, one document actually makes your business official, and it’s the Articles of Organization, or Form 49459. Of all the red tape you’ll have to overcome, this is the paperwork that matters most.

Filing official government documents like this can be intimidating or complicated for many people, which is why we’re here. With our business formation plans, our team of professionals handles the filing for you. We make sure it’s done quickly and correctly the first time. But, although we can handle this for you, we’ll show you how the process works below.

You can file your Articles of Organization online, by postal mail, or in person. To do so online, you’ll first need to create an account with Access Indiana, which you’ll use to access Indiana’s website for registering businesses, INBiz.

Required Information

To complete the Articles of Organization, you’ll need to know the following information:

- The name and address of your LLC, including the designator

- The name and address of your company’s registered agent

- Whether the LLC’s duration will be perpetual or for a specified period

- Whether the LLC will be member-managed (managed by the LLC’s owners) or manager-managed (managed by a manager appointed by the LLC owners)

- The signature of the LLC organizer

Be aware that, once submitted, this information in your Articles of Organization becomes public record.

Processing times vary, but your Articles are usually approved or rejected within 24 hours when you file online or in person. Filing by mail can take considerably longer, approximately 5 to 7 business days, not counting time in transit.

Member-Managed or Manager-Managed?

As with many states, Indiana asks you to list how you plan to govern your LLC, by the members/owners (member-managed) or by a manager (manager-managed).

Most LLCs choose to be managed by the members because they only have a few owners or just one. In those cases, it usually makes sense for the LLC owner(s) to do member-management because they’re running the business themselves. All of the owners are sharing in running the business and making decisions for it.

But some LLCs prefer to appoint or hire a manager instead. In the manager-managed option, one or more LLC members can be appointed to make management decisions, or someone from outside the LLC can be hired to manage the company.

Manager-management can be helpful when some of the members only wish to be investors in the company as opposed to running the business and making decisions about it. LLCs that have a lot of members also sometimes find it easier to have a manager because it’s difficult to get all the members together to make decisions on a regular basis.

How to Amend Your Articles of Organization

You need only file your Articles of Organization once. But if any of the original Articles of Organization information needs to be updated, altered, or expanded, your business is required to inform the state about the changes.

You would report these changes by filing Indiana Articles of Amendment and paying a filing fee. If your Articles of Organization isn’t current, it could impact your ability to get a Certificate of Existence (called a “Certificate of Good Standing” in most states). This document isn’t required to conduct business, but it’s important for business accounts, members, and potential investors. Basically, failing to keep your business up to date with state requirements can limit your LLC’s potential future growth.

Do you need help amending your Articles of Organization? We have an amendment filing service that can handle it for you, as well as our Worry-Free Compliance service, which includes two amendment filings every year.

Step 4: Create an operating agreement

Create an LLC operating agreement. Operating agreements outline the rules and procedures for the management of the LLC as well as establishing ownership percentages, how profits are divided among members, and much more.

Your Indiana operating agreement also makes your business appear more legitimate to banks, investors, potential business partners, and the courts. While Indiana doesn’t legally require you to file an operating agreement, if you don’t have one, your LLC will be governed by default by Indiana’s LLC laws, which might not reflect your wishes.

Once an operating agreement is signed by all the members, it becomes legally binding. You don’t need to file it with any government agency, but keep it with your other important legal business documents so you can refer to it easily.

Do I need an operating agreement if I’m the only owner?

It seems like most of the things in your operating agreement are intended to avoid disputes among the LLC members, so we understand why you might think you don’t need one if your LLC doesn’t have more than one member. But potential investors, future business partners, and others may want to see your operating agreement regardless.

Your operating agreement can also spell out what you want to happen to the business and its assets if you die or become incapacitated.

One more thing to consider: Occasionally, someone will take an LLC owner to court to try to prove that the owner and the LLC are the same entity so that they can go after the owner’s personal assets. If that happens, having an operating agreement in place is one more thing to further demonstrate to the court that the business owner and the LLC truly are separate.

What should be included?

Typical concepts in an LLC operating agreement may include:

- Procedures for admitting or removing LLC members

- Allocation of profits and ownership

- Management structure and voting requirements

- Procedures for dissolving the LLC and dividing its assets

If you’re not sure how to go about creating an operating agreement for your LLC, we have a customizable template to help get you started.

Step 5: Apply for an EIN

Apply for a federal employer identification number. Unless you’re a single-member LLC without employees (and sometimes even then), you’ll likely need to get an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). Even if you don’t legally need an EIN, getting one can help you open a business bank account or obtain credit to grow your business.

You can get your LLC’s EIN through the IRS website, by mail, or by fax. If you don’t want to deal with that particular government agency, we can get it for you. Our EIN service eliminates the hassle.

Can filing as an S corp lower my taxes?

The LLC business structure gives you more flexibility than a corporation. One of those flexibilities is how you can choose to have your LLC taxed.

By default, an LLC has pass-through taxation. This appeals to most owners of LLCs because it avoids “double taxation,” in which a corporation pays taxes at both the business level and again when the income is paid to the individual owners. But some LLCs opt to be taxed as a C corporation or an S corporation because, in their case, it works to their advantage.

Being taxed as a C corporation does mean you get double taxation, but, for certain LLCs, the pros can sometimes outweigh the cons. One benefit is that C corporations have the widest range of tax deductions, which could be an advantage in some scenarios, especially for more profitable LLCs. For example, insurance premiums can be written off as a business expense.

S corp is short for “Subchapter S Corporation” and is a tax status geared toward small businesses. Having your LLC taxed as an S corp has pass-through taxation like a standard LLC, but there’s another potential advantage for some LLCs: It could reduce your self-employment taxes.

Self-employment taxes are the portion of your taxes that pay for Social Security and Medicare. In a typical LLC, you would pay these on all of your profits.

But filing as an S corp allows you to be an “employee-owner” and split your income into your salary and your share of the company’s profits. In this way, you pay employment taxes on your salary, but not self-employment taxes on your profits. (You’ll still pay the other applicable taxes on your LLC profits, of course.)

The drawback is that the Internal Revenue Service scrutinizes S corps more closely, meaning you’re more likely to get audited. S corps also have more restrictions for qualifying.

While it’s possible that one of the above options could work better for your LLC, remember that business taxes are very, very complicated. They’re also very specific to your situation. That’s why you truly need to consult a tax professional to see which taxing method works best for your Indiana business.

If you decide to form your LLC with an S corp status, our S corp service can help you do that.

Register to pay Indiana state taxes

If your company will have employees or collect sales tax, you may need to register your LLC with the Indiana Department of Revenue and receive an Indiana tax identification number. For instructions on how to register your business, visit the Secretary of State business services division (INBiz) website.

You’ll need to register for all tax types applicable to your business. Some of the most common ones are listed below:

- Sales and use tax: If you sell products or tangible items

- Withholding tax: If you have employees

- Food and beverage tax: If you sell food and beverages in certain counties/municipalities

- County innkeeper’s tax: If you rent accommodations for less than 30 days in certain counties/municipalities

- Motor vehicle rental tax: If you rent motor vehicles

- Gasoline use tax: If you distribute gasoline or special fuel

- Tire fee: If you sell tires

- Safety fee: If you sell fireworks

Fortunately, you can register for most of the taxes above with a single application, Form BT-1 (also called the Business Tax Application), which incurs a small fee. You’ll need to do a separate application for each business location you have, though.

Step 6: Submit your LLC’s beneficial ownership information report

At the beginning of 2024, the Corporate Transparency Act went into effect, requiring a new filing for LLCs and other small businesses: a beneficial ownership information report, or BOI report. The act hopes to deter corporate financial crimes by making it more difficult to hide illicit activities behind shell companies. To do this, the BOI report asks businesses to disclose information about their beneficial owners.

Your LLC’s beneficial owners are the people who meet one or more of the following criteria: holding 25% or more of the LLC’s ownership interest, exerting substantial control, or receiving significant economic benefit from the LLC’s assets. For each beneficial owner you have, you’ll be asked to provide a name, address, and identifying documents.

You can submit your BOI report online with the Financial Crimes Enforcement Network (FinCEN), or you can upload a PDF version. Failing to file can have severe criminal and civil penalties, so be sure to file on time. If you organize during 2024, the report is due within 90 days of getting Indiana’s approval for your Articles of Organization. If you start in 2025 and beyond, you’ll need to file within 30 days. Any LLCs organized prior to 2024 have until January 1, 2025.

To learn more about this new report, check out FinCEN’s website. Or if you’re feeling overwhelmed at the prospect of filing it yourself, let our BOI report filing service handle it for you.

Post-Formation Steps

Even after your LLC is officially up and running in Indiana, there are a few key steps to finish to help ensure that your business stays compliant. Let’s talk through the requirements you’ll need to uphold.

Biennial Reporting Requirement

Every Indiana LLC (and foreign LLCs doing business in Indiana) must file a biennial Business Entity Report with the Indiana Secretary of State Business Services Division. The Business Entity Report contains basic information like your LLC’s name, filing date, and registered agent information.

You’ll need to submit your report every other year in the anniversary month of your LLC’s formation. For example, if you created your LLC on Aug. 13, 2020, you would need to file your biennial report in August of every even year (2022, 2024, etc.). Similarly, if you registered a foreign LLC with the Secretary of State Business Services Division in 2020, your biennial report will be due in 2022, 2024, etc. There are separate fees for filing online or by mail.

We can help you with your Business Entity Report in a couple of ways. First, our annual report service will help you file your Business Entity Report. Second, our Worry-Free Compliance service not only helps with filing your report, but also sends you other important compliance reminders and helps you with two amendment filings each year.

Open a bank account after getting an EIN

Once you’ve secured an EIN, you’ll be able to open a business bank account. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time. It also helps you avoid commingling funds. Commingling funds makes your taxes more difficult to sort out, and it could also be used against you if someone takes you to court to challenge whether you and your LLC are truly separate entities (i.e., they want to sue you for not just your business assets, but also your own assets). You may also want to get a business credit card to make small purchases and start establishing your company’s credit score.

We offer a discounted bank account for your new business. This allows for unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

For further help managing your new business’s finances, try ZenBusiness Money. It can help you create invoices, receive payments, keep track of deductible expenses, transfer money, and manage clients all in one place.

Hire employees compliantly

If you plan to hire employees, you’ll need to fulfill a few requirements. For one thing, you’ll need to pay unemployment insurance taxes at the federal and state level, completing the appropriate registrations. At the state level, you’ll register and pay with the Indiana Department of Workforce Development (DWD). This must be done during the first quarter you are liable to pay premiums.

You can register online using the DWD’s online Uplink Employer Self Service program. The DWD will give you an individual account number when you register.

You’ll also need to get workers’ compensation insurance from a private insurance carrier. If an employee injury occurs and results in more than one day away from work, employers must file an Indiana Workers’ Compensation First Report of Employee Injury, Illness form.

Finally, bear in mind that you’re required to complete new hire reporting. In Indiana, all public, private, nonprofit, and government employers are required to report all new and rehired employees within 20 days of hiring. You’ll report to the Indiana New Hire Reporting Center. Failing to report a new employee could result in a $500 fine.

Pros and Cons of an LLC in Indiana

An LLC is a popular business entity choice for a lot of small business owners in the Hoosier State. But it’s important to remember that there are pros and cons to an LLC (or any business type). Let’s walk through those.

Advantages

The primary advantage of an LLC in Indiana is the limited liability protection it offers. This protection helps ensure that the personal assets of the owners are separate from the business liabilities. Additionally, LLCs in Indiana enjoy tax flexibility, as they can choose how they are taxed, potentially leading to significant tax benefits. Furthermore, operational flexibility is another key benefit, with fewer formalities and compliance requirements compared to corporations.

LLC Tax Benefits

Like we mentioned earlier, LLCs have the option to pick their taxation structure. If you’re like most business owners, then you probably don’t want to spend a lot of time considering your taxes. But this decision is well worth your time and effort.

The default tax status often suits a lot of small businesses, since personal income tax rates are sometimes lighter than corporate tax rates. But that’s not always the case. For high-earning businesses, being taxed like a C corporation can lead to certain tax breaks. For example, a C corporation has the widest variety of eligible tax deductions. Taking advantage of these might lower the business owner’s overall tax liability.

Certain LLCs can even elect S corporation status, which lets you keep pass-through taxation and pay yourself like an employee. For many businesses, this can lead to a lower tax burden on self-employment taxes.

The true luxury is that with an LLC you can pick and choose the tax structure that works best for you. Before you jump into a particular tax status, it’s highly recommended to chat with an Indiana tax attorney. They’ll be able to talk you through the pros and cons of each tax status for your business’s unique finances, helping you get the most favorable tax liability possible.

In short, an LLC offers business owners the most strategic tax options to pick from.

Disadvantages

However, there are also challenges to consider. Compared to sole proprietorships and general partnerships, LLCs in Indiana may face complexities and costs associated with compliance, such as filings for the biennial Business Entity Report and adhering to state-specific regulations. Furthermore, raising capital can be more challenging for LLCs, as they don’t have the ability to issue stock like corporations. There’s also a risk of losing the liability protection if the LLC doesn’t maintain proper corporate formalities.

Types of Indiana LLCs

There are actually a few different types of LLCs to choose from. Let’s walk through the nuances you’ll want to understand as you get started.

Single-Member LLC

A single-member LLC is any LLC owned by just one person (called a member). The owner has full responsibility for business decisions and enjoys all the profits.

Multi-Member LLC

A multi-member LLC is an LLC owned by two or more members. An operating agreement is especially important for a multi-member LLC, as it governs how the members will interact, share responsibilities, distribute profits, and much more.

Foreign LLC vs. Domestic LLC

A domestic LLC is an LLC that was formed in the state; a foreign LLC was created in another state and has been granted authority to transact business in Indiana.

Series LLC

A series LLC allows businesses to create different “sub-LLCs,” or “series” under a master LLC, much like a holding company. Some business owners go this route to isolate liability of certain aspects of their business.

Indiana is one of a few states that allows a series LLC, but please note that the process of creating a series LLC is slightly different.

LLC vs. Other Business Entities

An LLC isn’t the only business structure that you can choose for your new company. Before you form your LLC, it’s important to evaluate all your options.

Sole Proprietorship

Compared to an LLC, a sole proprietorship is simpler to set up and requires less paperwork; you can simply start doing business without filing any business formation paperwork. There aren’t biennial reports to file, either.

However, a sole proprietorship doesn’t provide any personal liability protection, meaning personal assets are at risk if the business incurs debt or legal issues. LLCs avoid this issue, as the business is a separate legal entity from the owner.

Partnership

A partnership is similar to a sole proprietorship but involves two or more individuals. The partners write up a partnership agreement to dictate how they’ll work together, share profits, and so on (not dissimilar to an LLC’s operating agreement). There are a few different types of partnerships with varying degrees of personal asset protection, from the unprotected general partnership to the limited liability partnership.

While some partnership types have a little liability protection, LLCs are generally regarded as offering better liability protection for business owners.

Corporation

A corporation offers significant personal liability protection and can raise capital by issuing stock. This makes a corporation a popular choice for businesses that need a lot of start-up capital or for owners who have aspirations of selling stock to the public later on. LLCs have a much harder time raising startup capital because they can’t issue stock.

That said, a drawback to a corporation is that it faces double taxation (on both corporate profits and dividends), which often means a bigger tax burden. A corporation also requires more formalities and thorough record-keeping compared to an LLC.

Each business structure has its unique set of advantages and disadvantages, and the choice depends on the specific needs and goals of the business. If you’re not sure what company type is right for you, we highly recommend chatting with a business attorney to talk through your unique goals.

We can help you form an LLC in Indiana

If you follow all the steps above, you should be the proud owner of a new LLC! But there’s still more to know than just how to start an LLC in Indiana. You need to know about things like hiring employees, getting business licenses and permits, getting additional financing if you need it, how to make changes in your business, and how to stay in compliance with the government.

We offer many services beyond just helping you form your LLC. Our business experts can also give you long-term business support to help run and grow your company.

So, if the paperwork of starting a business feels as frustrating as trying to predict the local weather, we can help. Let us take care of LLC formation, compliance, and more. That way, you can get back to running your dream business, whether it’s a hair salon in Carmel or a pork tenderloin sandwich food truck in Bloomington.

Related Topics

IN LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Indiana LLC FAQs

-

The state fees for forming an Indiana LLC can range from $95 to $120, depending on factors such as your method of filing and whether you choose to reserve your business name. Note that fees change over time, so you should check the Indiana Secretary of State’s website for the most recent fee schedule.

-

The benefits of forming an Indiana LLC include:

- Separating and limiting your personal liabilities from your business debts and obligations

- Quicker and simpler filing, management, compliance, and administration than a corporation

- Avoiding the “double taxation” of most corporations

Learn more about the LLC business structure.

-

By default, an LLC is taxed as a pass-through entity, meaning that the business itself typically doesn’t pay federal income tax on profits. Instead, the owners pay taxes on their share of the income on their personal tax returns. However, LLCs can also elect to be taxed as C corporations or as S corporations, depending on what their circumstances are. Then there are state and local business taxes to account for, too.

Even for business entities like LLCs, taxes can get very complicated. We strongly recommend consulting a tax professional. They can keep you out of trouble with tax collectors and potentially find tax savings you weren’t aware of.

-

If you file a paper application by postal mail, processing usually takes five to seven business days. However, if you file online, you’ll often receive a stamped copy of your Articles of Organization within 24 hours (if it’s approved).

-

No. The operating agreement is an internal document that you should keep on file for future reference and doesn’t need to be filed with any government office.

-

That’s going to depend on your individual circumstances and goals. Most LLCs elect pass-through taxation, where the LLC’s members are only taxed on their earnings at the individual level without first being taxed at the business level.

If you choose to be taxed as a C corporation (the default form of corporation), you’ll be taxed twice on your profits — once at the entity level and then at the individual level when you file your personal tax returns. Despite this double taxation, certain LLCs may benefit from this tax structure, as it has the most possible deductions.

Being taxed as an S corporation also has pass-through taxation, but it also allows LLC members to earn money from the business both from its profits and by being paid a salary. In some instances, this could reduce the self-employment taxes members pay because they would pay the Social Security/Medicare portion of their taxes on their salary, but not their share of the LLC’s profits.

Again, a qualified accountant should be able to advise you as to which tax arrangement would most benefit your LLC.

-

In a Series LLC, multiple categories of LLC interests have distinct ownership, rights, and legal obligations. Many owners use Series LLCs to protect separate business units from cross-liability.

Although not many states permit a Series LLC to be formed, Indiana does. However, forming one requires a different process than a standard LLC.

Note: ZenBusiness doesn’t assist with Series LLC formation at this time.

-

Indiana doesn’t require a statewide general business license, but your LLC is still likely to need licenses and permits of some kind to operate legally. INBiz has a list of state permits and business licenses your LLC may need to obtain to remain compliant with Indiana law.

However, licensing also happens at the federal and local levels, and different industries require different licenses and permits. So, there’s no one central place to check to see if you have every license and permit you need. You’ll have to do some research.

If you don’t have the time or inclination to do all this research, or if you just want the security of knowing that your business has all the licenses and permits it’s legally obligated to have, our business license report service can do the work for you.

-

Before starting the dissolution process, the members of an LLC should consult the operating agreement and follow all established rules for dissolving the LLC. For subsequent steps, please refer to our Indiana business dissolution guide.

-

An LLC that was formed in a different state is referred to as a foreign LLC. All foreign LLCs must submit a Foreign Registration Statement (Form 56369) to confirm their eligibility to conduct business in Indiana, pay the required fee, and follow all of Indiana’s rules for getting a foreign qualification.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Indiana

Ready to Start Your LLC?